A short excerpt of our track record. Detailed information and further reference objects can be found in the closed investor area.

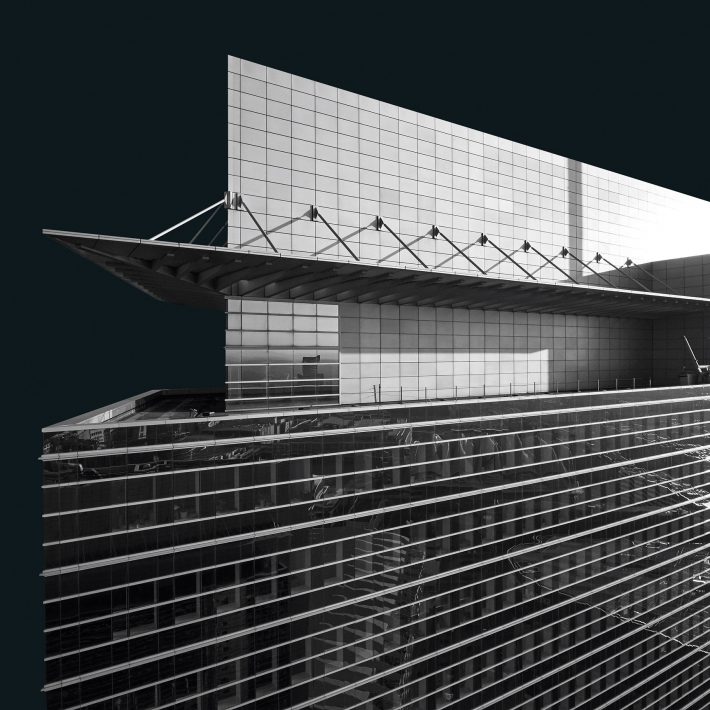

Pollux/Frankfurt

Frankfurt’s high-rise icon Pollux was acquired as an “off-market” transaction in Q3–2014 in a joint venture with The Blackstone Group. The 130-meter-high property has rental space of more than 32,000 sqm, which is spread over 33 floors. At the time of purchase, the property was only 15 % let and suffered from a negative perception within Frankfurt’s real estate community.

Via a targeted package of measures, occupancy could be significantly increased from 15 % to 100 % within 36 months. In this context, leases with renowned tenants such as Zurich Insurance Group, Lavazza, AON and the state of Hesse for the Tech Quartier could be agreed. In addition, building quality could be enhanced by selectively investing capex.

60327 Frankfurt am Main

Goldenes Haus/Frankfurt

Together with Swiss Partners Group, Finch Properties acquired the “Golden House” from Commerz Real in Q4 – 2017 in an “off-market” transaction. “Golden House” was extensively revitalised in 2001 and equipped with a “state-of-the-art” building technology. The ten-story asset offers one of the most efficient floor plans in the local office market.

Already before closing the lease with one of the two main tenants could be extended, increasing the WALT (weighted average lease term) from less than 2 years to some 3 years.

60486 Frankfurt am Main

Main Airport Center/Frankfurt

In 2015, Finch Properties, together with an US investor, acquired the Main Airport Center (“MAC”) office complex in immediate vicinity to Frankfurt Airport. The office building comprises of 60,812 sqm of rental space including conference area, staff restaurant, a cafeteria and parking facilities with a capacity of 1,470 spaces, including a petrol station.

The renowned tenant mix initially had a WALT of less than 2 years at the time of acquisition. Within 24 months, rental levels could be stabilised, leading to a WALT of almost 6 years with an occupancy rate of 95%. Additionally, Finch significantly reduced operating costs and upgraded food and beverage areas to enhance quality of stay. New lettings and prolongations secured new leases for an area of almost 35,000 sqm within a very short time.

Finally, at the end of 2017, “MAC” was sold to CapitaLand, with 92 billion SGD AUM one of the biggest Asian investors from Singapur. Finch Properties continues to provide asset management services for the new owner.

60549 Frankfurt am Main

Carnival/Köln

Project “Carnival” was acquired as an off-market transaction in Q1–2018 in a joint venture with Tristan Capital Partners. The building complex comprises approx. 40,000 sqm rental space, spread over six different building parts, with up to 18 floors.

The main tenant, Deutsche Telekom AG, operates several traffic junctions with strong pan-European relevance. Formerly used as a telecommunications office, the tower still carries radio and radio broadcast antennas.

50676 Köln

Accent Office Center/Frankfurt am Main

The Accent Office Center (AOC) was acquired in Q1 – 2019 in a joint venture with Tristan Capital Partners and comprises more than 25,000 sqm of rental space spread over 6 floors and 6 buildings.

The AOC is rented to around 40 office users, with retail and gastronomy on the ground floor complementing its use. The balanced tenant mix ensures a stable cash flow and at the same time offers potential that can be exploited through active asset management.